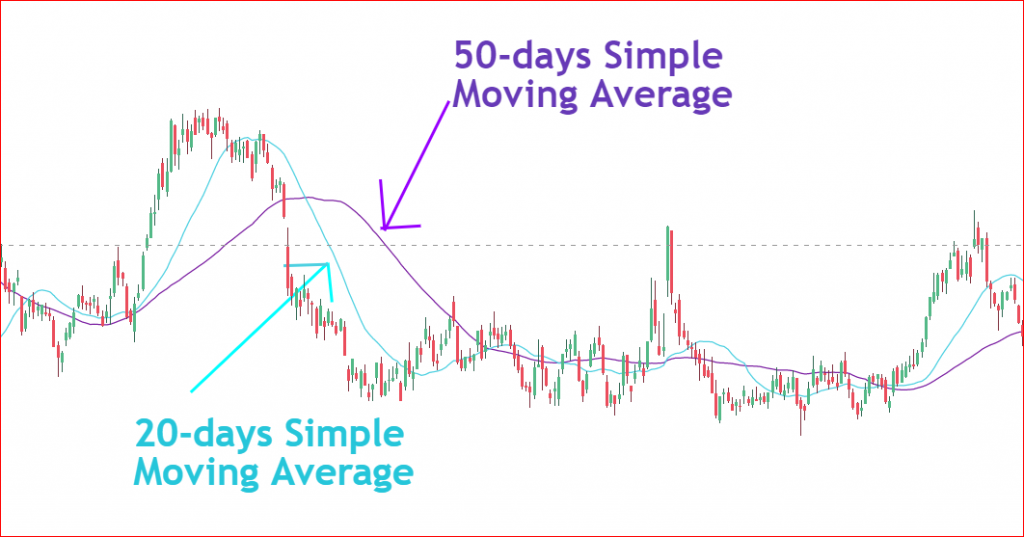

df retrieves the high price delta between current and 2 days later.df retrieves the close price delta between current and prev.You can also use _delta as a shortcut to _-1_d Using pattern _d to retrieve the delta between different periods. Change of the Closeĭf is the change of the close price in percentage. RemovingĮxisting columns so that they will be re-evaluated the next time you access them. And they won't affect the existing results. Some statistics have configurable parameters. This operation generates lots of columns. Some indicators, such as KDJ, BOLL, MFI, have shortcuts. Some statistics require the window size but not the column name. 1 period delta of the high price: high_-1_d.10 periods exponential moving average of the close: close_10_ema.5 periods simple moving average of the high price: high_5_sma.Such as delta, shift, simple moving average, etc. Some statistics need the column name and the window size, Use macd = stock or rsi = stock.get('rsi') to retrieve the Series. Please delete those columns first if you want the The values of these columns are calculated the first time you access We allow the user to access the statistics directly with some specified column Of pandas.DataFrame should work the same as before. StockDataFrame is a subclass of pandas.DataFrame. Note that unwrap won't reset the columns and the index. Use unwrap to convert it back to a pandas.DataFrame. StockDataFrame works as a wrapper for the pandas.DataFrame.

Sma ema stock calculation license#

The build checks the compatibility for the last two major releases of python3 andīSD-3-Clause License Tutorial Initialization

Stock Statistics/Indicators Calculation Helper

0 kommentar(er)

0 kommentar(er)